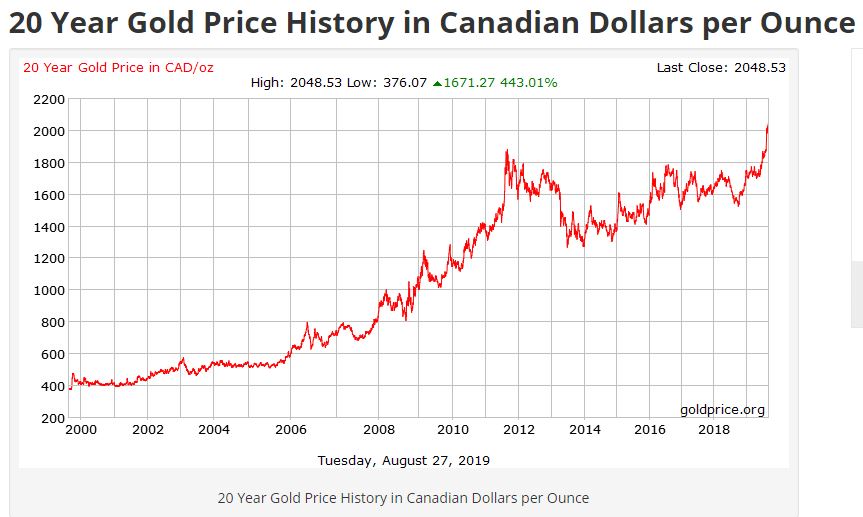

Not sure where to put your hard-earned investment dollars? While stocks and bonds can fluctuate, precious metals usually tend to rise, making silver and gold smart investments. But with so many options out there, it can be confusing deciding which precious metal option is best for you.