Not sure where to put your hard-earned investment dollars? While stocks and bonds can fluctuate, precious metals usually tend to rise, making silver and gold smart investments. But with so many options out there, it can be confusing deciding which precious metal option is best for you.

Bullion ranges from a 99.9% purity to 99.999% purity and are priced accordingly. The main difference between bullion is the size, shape, and mint. When it comes to buying bullion, it boils down to a personal preference. Some investors prefer coins while others prefer bars.

Bars, Coins, and Rounds

When a new investor thinks about bullion, they typically envision gold or silver bars; however, bullion comes in bars, coins, and rounds.

Bars hold no face value or numismatic value. They are purely worthy their weight in gold or silver. Bars typically have no dates, and instead often have serial numbers. However, mints rarely track where the bars are sold. Gold bars can be found in 99.9% or 99.99% purity. Most silver bars are .999 purity but can occasionally be found in .9999 purity.

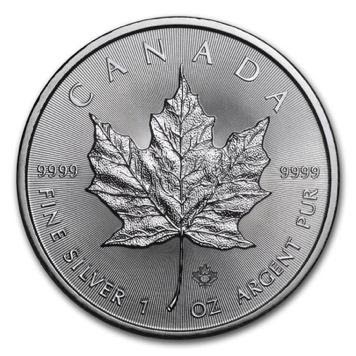

Coins typically carry a higher premium than bars, but also hold a higher resale value. Coins have a face value (e.g. a gold maple has a $50 face value). Most coins have dates on them, which identifies the year it was minted, but also often attracts collectors who looking to buy bullion to represent birthdays or anniversaries. Most coins are .9999 pure, however some coins are only .999 pure. Only the Royal Canadian Mint provides an option for .99999 pure coins.

Rounds have a similar look to coins, however, hold no face value or date. Most rounds, in both gold and silver are .999 pure. Rounds often have lower premiums than bars or coins, but also have a lower liquidity rate or resale value.

Recognized vs Unrecognized

A recognized mint is a popular mint that is identified by the bullion industry for its validity, purity, and desirability. Recognized mints tend to hold higher resale values and can be easier to liquidate.

Popular Recognized Mints

Royal Canadian Mint:

Founded in 1908, the RCM (Royal Canadian Mint) is a government-backed producer of both bullion and legal tender. The RCM strives to lead the industry in terms of purity, creating the first .9999 pure gold coin in November of 1982. In 2005, the RCM accomplished its first .99999 gold maple, the purest gold coin in the world. In 2014, the RCM began adding DNA anti-counterfeiting technology to its gold maples, making them the most secure billion coins in the world. From special edition collector coins to standard bullion bars in both gold and silver, the Royal Canadian Mint offers something for everyone.

Engelhard:

Founded in 1902 in New Jersey, Engelhard is one of the world’s oldest metal manufacturers. However, they did not start producing bullion until the 1980s and ceased production in 1988. While still widely available, it is not known how many of these bars still exist, making them quite desirable to collectors. Engelhard created both poured and struck bars.

Johnson Matthey:

Founded in 2011 in Texas, USA, JM is a newer, yet highly sought-after mint. While the company itself sells a variety of mints, they mint their own bullion as well. Specializing in both struck and poured bars, JM bullion appeals to investors and collectors alike.

Choosing which kind of gold or silver is up to you. At the end of the day, precious metal ownership is clearly a smart plan.